Interview: What (costs) to expect when you’re expecting (to start an emerging VC)

Getting the CFO’s perspective from Airstream Alpha on budgeting for a micro-VC

Originally published at https://oper8r.substack.com/p/interview-what-costs-to-expect-when

TLDR

One of the key unknown unknowns of starting a micro-VC is knowing what it will cost to run one

An outsourced-CFO shares a summary overview, sample budget, and perspectives on what to expect

“Spending is not always your enemy” - minimizing expenses may maximize investable capital, but can also limit a VC’s ability to do their job effectively

Emerging VCs with small teams should employ a “team-building” mindset, and think of service providers as extensions of the team, and not just necessary evils

I’m excited to talk with Doug Dyer, Founder of Airstream Alpha, an outsourced-CFO firm started by a team experienced working with VCs, LPs, and startups, so has seen the fundraising/investment and financial operating view from every side of the table.

Doug joined us in our summer cohort to share his perspectives with its members. He is here again to do a deep-dive into some of his insights.

Here’s a photo of Doug in action (not really):

Photo by Karolina Grabowska from Pexels

Doug, we’re delighted to have you here! To start, tell us a bit about yourself and your firm.

Thanks, Winter! I was born and raised in North Carolina (great BBQ & basketball). Professionally, I began my finance career in investment banking, then moved to private equity, venture capital and hedge fund investing in 2010, first at Morgan Creek Capital and then at Texas Children's Hospital. I’ve managed >$1 billion of investments in >100 funds and companies over more than a decade, working with some amazing investors and entrepreneurs.

My true passion is working closely with funds and companies, which led me to found Airstream Alpha in 2018. We’re based in Austin, TX, and help CEOs and GPs that typically don’t yet have a CFO . We’ve worked with >30 funds & companies as CFO since 2018 (the funds we’ve worked with have raised >$500 million).

Most emerging VCs don’t have a CFO. So, from the CFO perspective, what problems should these VCs be anticipating?

As a VC, your key priorities are to raise capital and invest in great companies. However, you still are running a business, which requires more time and attention than most expect.

We’ve found that new VCs can spend >100 hours establishing their fund and setting up operations. Then there’s the continued time required to make sure the fund operates effectively going forward.

Generally speaking, what are the typical expenses that a VC should expect? Who is responsible for paying for each category?

Expenses usually fall into one of three categories: Organizational, Management Company, and Fund.

Organizational expenses are associated with forming the fund (legal, accounting, setup, organizational, marketing, etc.). These are typically capped at a fixed dollar amount, depending on the strategy and investors. These expenses are typically paid for by the investors in the fund.

Management Company expenses are required to “run the business,” such as salaries & benefits, your VC tech stack, and operating expenses. These are paid for by the management company. Salaries & benefits are most predictable as they’re driven by market rates. Other operating expenses like legal, tax, and other professional services can vary, depending on market and level of expertise.

Fund expenses are related to the fund and portfolio companies, such as fund administration, fund audit & tax, travel & entertainment related to acquisition, disposition, and holding of fund investments. These expenses are paid by the fund, not the management company, so they don’t impact the management company budget. However, they do reduce net returns to investors, so managing prudently is important.

If a VC can charge certain expenses to the fund, what motivates them to cut costs?

Charging expenses to the fund means drawing down from the amount of committed capital from investors, which will reduce net returns to investors. Conversely, keeping fund expenses at a reasonable level can enhance your returns and measured performance.

Sophisticated LPs often ask to see an example budget to understand how a VC is operating. Generally, LPs prefer that VCs use management company revenue to invest in their team and resources, instead of generating large profits for the GP. Returns from investments and ultimately carried interest should be the larger, more meaningful driver of returns for the GP.

A VC’s ability to manage these expenses will be of value in future funds. LPs look at this expense ratio to ensure the maximum amount of their committed capital goes towards fund investments. Demonstrated experience effectively managing expenses should increase the likelihood of LP commitments to future funds.

So it’s like being the CEO of a startup, right? You can burn equity capital on all sorts of expenses, but that reduces the amount of capital you have available to actually generate revenue and growth for the firm.

Right! So the best VCs tend to be great at both investing and running an asset management business, which means being thoughtful about the tradeoffs between investing capital in a startup, or in a resource that will make you more effective at generating returns.

Tell us about your cost model.

I’ll walk through an example with the following assumptions for an emerging VC. Our Fund Financial Model Template is dynamic, so VCs can plug in their own assumptions. But let’s keep it simple.

Source: Airstream Alpha

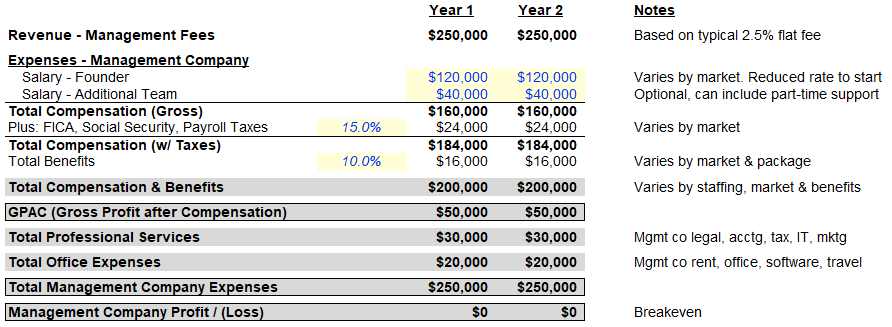

Here’s a basic example of a two-year Management Company financial model based on those assumptions:

Source: Airstream Alpha

Can you break down the professional services and office expenses? What is normal for these?

One quick point first - while it’s important to choose quality professional service providers, this does not mean you have to choose the most recognizable, most expensive “brand name.”

I’m not knocking these firms as I’ve worked with and think highly of them. However, if you don’t have a relationship with someone there that can get you a lower rate as an emerging VC, it’s best to consider providers at a more reasonable price point. You can still find very credible firms that have worked with GP’s that have successfully raised institutional capital - use your network and ask for references to vet this.

Professional services will typically include expenses such as legal, tax, finance, accounting, outsourced IT, and marketing expenses. In our table below from our fund model template, we’ve provided general guidance on what emerging VCs can expect to pay for certain professional services.

Source: Airstream Alpha

Regarding office expenses, that’s an interesting one, especially in the current environment. Office expenses have historically included rent, office supplies, internet, phone, and software.

What should emerging VCs expect for Fund expenses? Why target <1%?

These are costs related to the fund and portfolio companies, such as fund administration, fund audit & tax, travel & entertainment related to acquisition, disposition, and holding of fund investments.

It’s generally best to keep these at <1% of the fund size to minimize the fee drag on net returns to LPs. This also preserves your ability to invest more capital in great companies. For a $10m fund, an extra 1% over 10 years is 10%, or $1m total. That’s $1m that isn’t invested in companies, which is a meaningful amount relative to fund size.

Here’s a basic example of a two-year fund expense forecast based on a $10m fund size and general market rates:

Source: Airstream Alpha

What’s your advice to emerging VCs that are starting out?

Starting your own fund as an emerging VC is an exciting time - enjoy it and be proud of all that you’ve done to get here. As a former LP investor and CFO, here’s my advice to emerging VCs:

Create and manage a budget that fits your strategy: We often hear from emerging VC’s that have already spent five figures for “advice” from professional service providers. Talk to at least three different vendors in a category before moving forward to understand differences and drive best pricing; and don’t forget to ask fellow emerging VCs what’s working for them

Trial and error can be expensive, so try to minimize it: You can avoid blowing your budget on unknown unknowns by leveraging open resources like our Model Template and blog, Oper8r’s insights, Vela Wood’s Venture Glossary

Don’t obsess over cutting costs: Spending is not always your enemy. You still need to spend money to leverage your time so you can continue to make your LPs and portfolio companies successful

Adopt a “team-building” mindset: Emerging micro-VCs are notoriously under-resourced, and under-staffed. But don’t despair! Since the market for emerging VCs has grown, an ecosystem of service providers has evolved with it, and continues to do so. Instead of trying to do everything yourself, spend time exploring external team resources - advisors, fund admins, experts, etc. - that you can use to leverage your time and resources. This can make the difference between flaming out and building a durable platform.

With proper planning and setup, the internal finance function can be effectively managed and help drive greater returns, build trust with LPs, and increase the likelihood of successfully raising a follow-on fund.

Thank you again, Doug! We look forward to having you back soon.

Any time!

Special thanks to David Perretz and Welly Sculley for their significant contributions to this article.